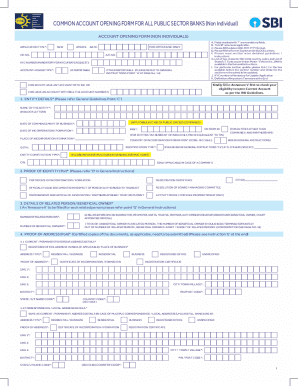

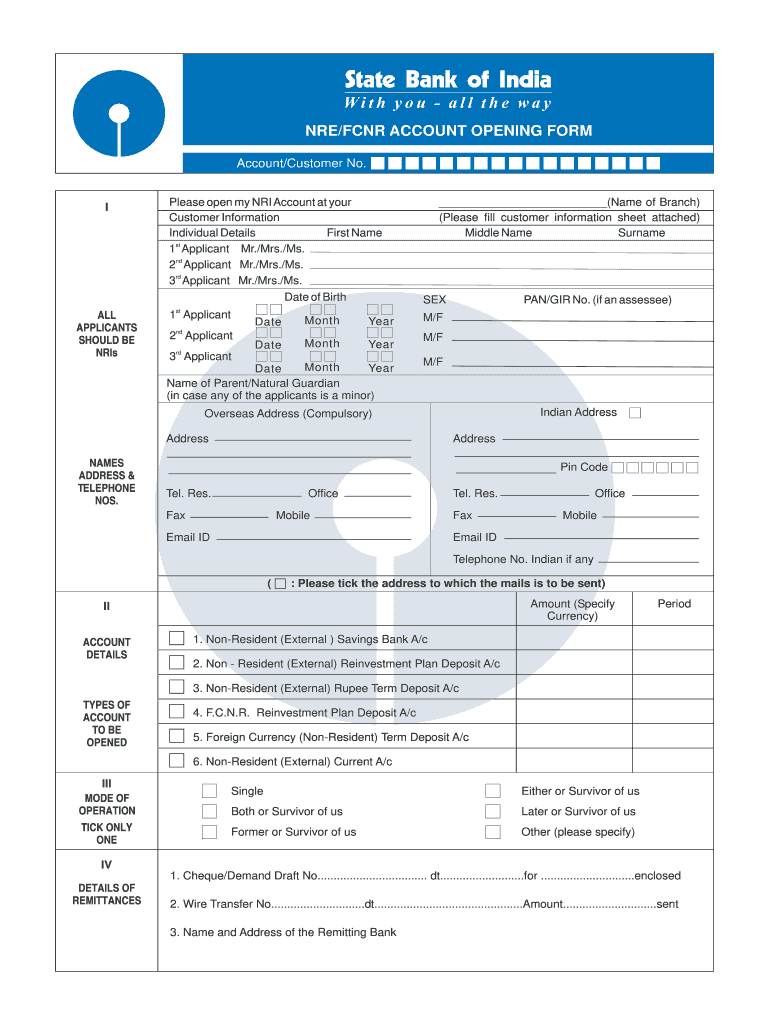

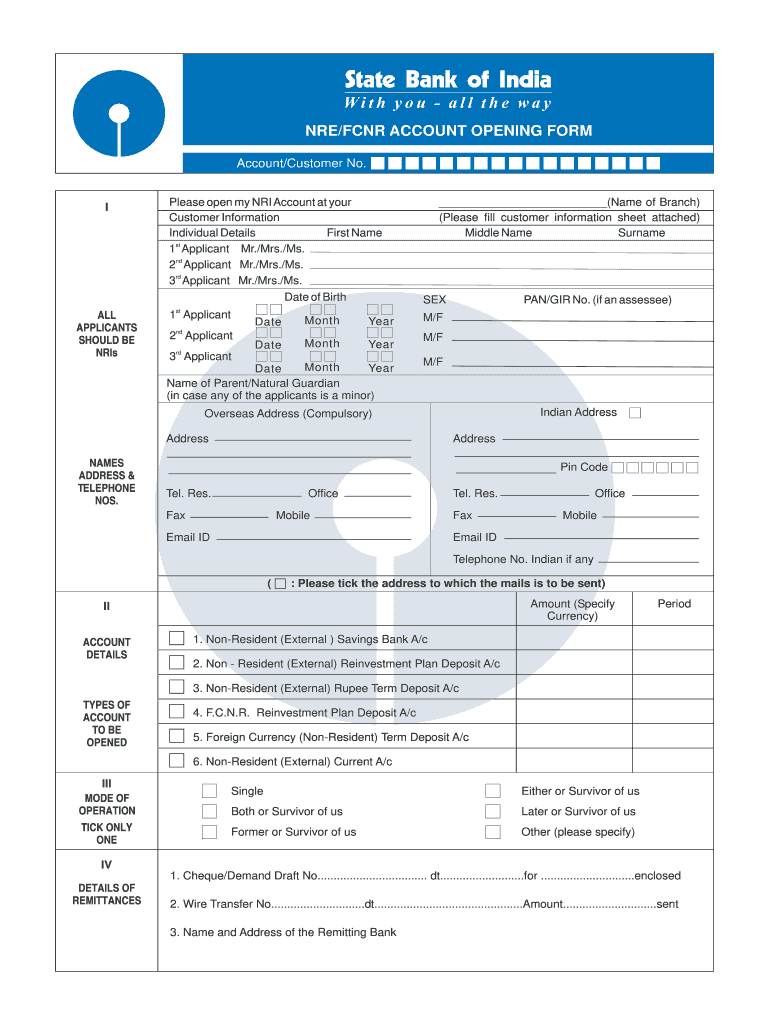

IN NREFCNR Account Opening Form free printable template

Show details

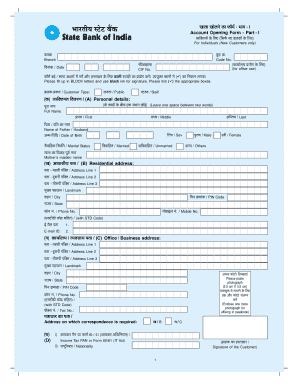

Account Opening Form (Deposit Account). For Resident Individuals. ONE RIGHT DECISION CAN CHANGE YOUR LIFE. The Banker to every Indian ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sbi form pdf download

Edit your account opening form sbi online form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sbi bank new account form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sbi online new account opening form fill up online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sbi online account opening form fill up. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sbi new account opening form fill up online

How to fill out IN NRE/FCNR Account Opening Form

01

Obtain the IN NRE/FCNR Account Opening Form from the bank's website or branch.

02

Fill in your personal details such as name, date of birth, nationality, and address.

03

Provide your passport information including passport number, issue date, and expiry date.

04

Enter details of your occupation and the source of your income.

05

Specify the type of account you wish to open (NRE or FCNR) and the currency preference.

06

Provide your overseas and Indian residential addresses if applicable.

07

Attach the required documents including passport copy, visa, and proof of income.

08

Sign the declaration at the end of the form affirming the accuracy of the information provided.

09

Submit the completed form along with the documents to the bank branch.

Who needs IN NRE/FCNR Account Opening Form?

01

Indian citizens residing abroad who wish to manage their income in India.

02

Non-Resident Indians (NRIs) who want to save in Indian currency.

03

Foreign nationals married to Indians wanting to open a bank account in India.

04

Individuals who receive income in foreign currency and want to maintain an account in India.

Fill

online sbi form fill up

: Try Risk Free

People Also Ask about sbi form sample download

What is the process to open SBI account?

The applicant(s) will need to come to the branch, in person, for opening the account and will sign at the relevant places in the presence of a Bank Official. Accounts can also be opened digitally though YONO app. Accounts can be opened using Video customer Identification Process where there is no need to visit Branch.

How can I open SBI account online without going to bank?

How to open SBI Insta Plus Savings Account? : Download YONO App. Click New to SBI—Open Savings Account → Without Branch visit→ Insta Plus Savings Account. Enter your PAN, Aadhaar details. Enter OTP sent to Aadhaar registered mobile number. Enter other relevant details. Schedule Video Call.

Can we open a new bank account online?

Yes, this step is also very easy and saves a lot of time. For opening Savings Account online, all you need is a mobile number for initiating the process. One just needs to submit the application and attach documents online instead of going to the bank yourself.

Which banks allow to open bank account online?

With HDFC Bank InstaAccount open a Savings Account instantly in a few simple steps. It comes pre-enabled with HDFC Bank NetBanking and MobileBanking and you can enjoy Cardless Cash withdrawals.

How can I open new SBI account online?

Step 1: Download the YONO App in your phone. Step 2: Open the YONO App and select 'New to SBI' and then 'Open a Savings Account.' Step 3: next, select 'Without Branch Visit' option. Step 4: You will be redirected to a new page where you have to enter your PAN and Aadhaar details.

How can I open a new bank account online?

Once you have that ready, here's how to open a bank account online: Go to the bank's website. Stay safe! Choose the type of account you want. Fill out an application. Agree to let the bank collect some information. Check the approval process. Make your first deposit.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get sbi pdf form?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the sbi zero balance account form in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit sbi form pdf in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing sbi saving account form and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit sbi form fill up straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing sbi account form download.

What is IN NRE/FCNR Account Opening Form?

The IN NRE/FCNR Account Opening Form is a document required to open a Non-Resident External (NRE) or Foreign Currency Non-Resident (FCNR) account in Indian banks. It collects necessary personal and financial information.

Who is required to file IN NRE/FCNR Account Opening Form?

Non-resident Indians (NRIs) who wish to open an NRE or FCNR account are required to file the IN NRE/FCNR Account Opening Form.

How to fill out IN NRE/FCNR Account Opening Form?

To fill out the form, the applicant must provide their personal details, financial information, source of income, and other required documentation as specified by the bank.

What is the purpose of IN NRE/FCNR Account Opening Form?

The purpose of the form is to gather essential information from NRIs for the opening of NRE or FCNR accounts, ensuring compliance with regulatory requirements.

What information must be reported on IN NRE/FCNR Account Opening Form?

The form requires reporting personal details such as name, address, nationality, passport details, source of income, and details of the foreign bank account, if applicable.

Fill out your IN NREFCNR Account Opening Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Account Form Opening is not the form you're looking for?Search for another form here.

Keywords relevant to sbi form filling

Related to sbi new account opening form fill up

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.